Last updated on July 6, 2021

According to IBISWorld,

There has been conflicting trends over last five years to 2020, hampering the Cereal Production industry in Canada. Demand has waned for cereal products as consumers shifted to pricier breakfasts as disposable incomes recovered. Moreover, as people returned to work, they had less time to prepare breakfast. Instead, Canadians opted to buy food at cafes or coffee shops, decreasing demand for cereal.

What’s more, diet trends are on the rise, with intermittent fasting being the most popular diet trend among consumers. 40% of consumers have already tried intermittent fasting, with breakfast being the most likely meal they give up. This may be the new cereal killer threatening the humble cereal category.

What does this mean for cereal brands? Caddle asked the questions and here are the answers:

Have you heard the phrase: Good habits start in the morning? Well, Caddle found out that consumers who eat cereal for breakfast are stickier compared to consumers who eat cereal as a snack throughout the day.

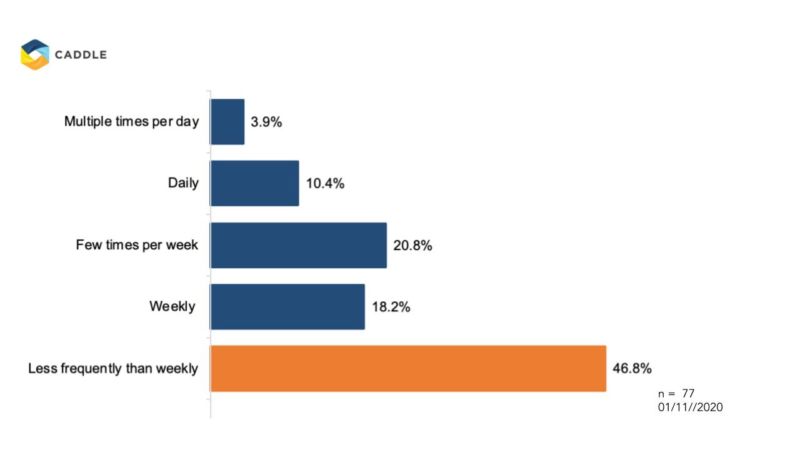

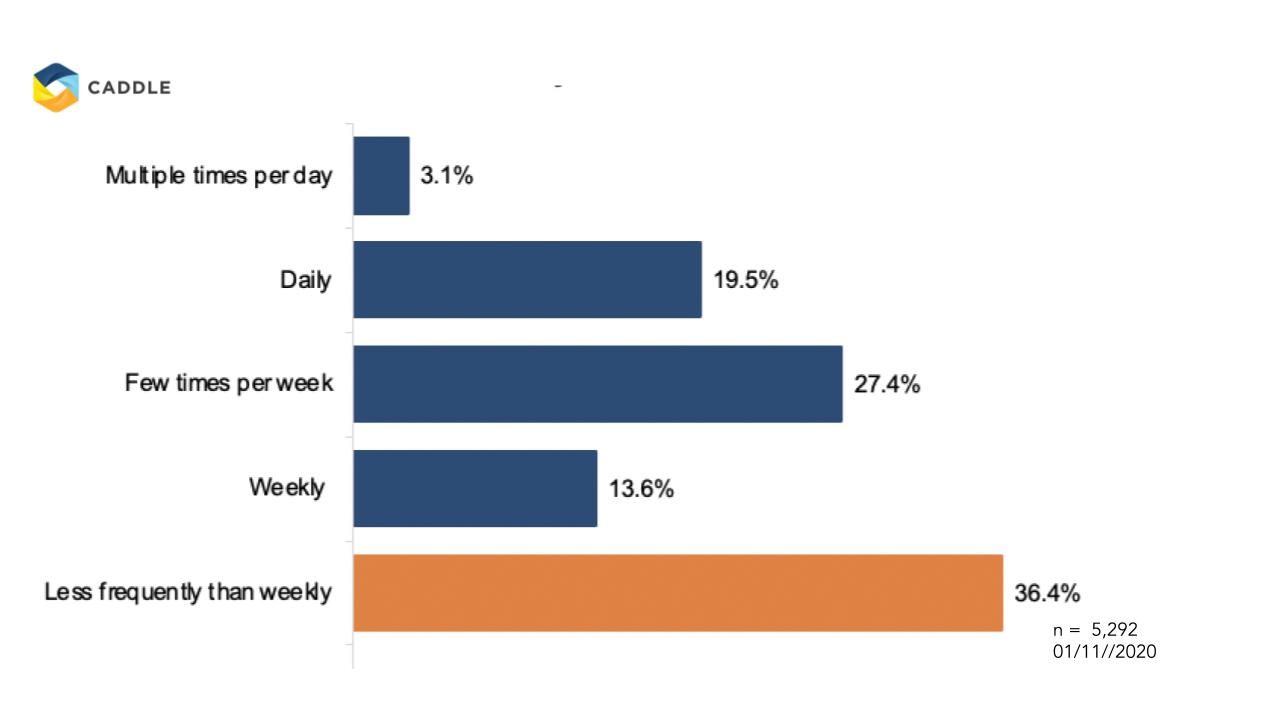

How often do you eat cereal?

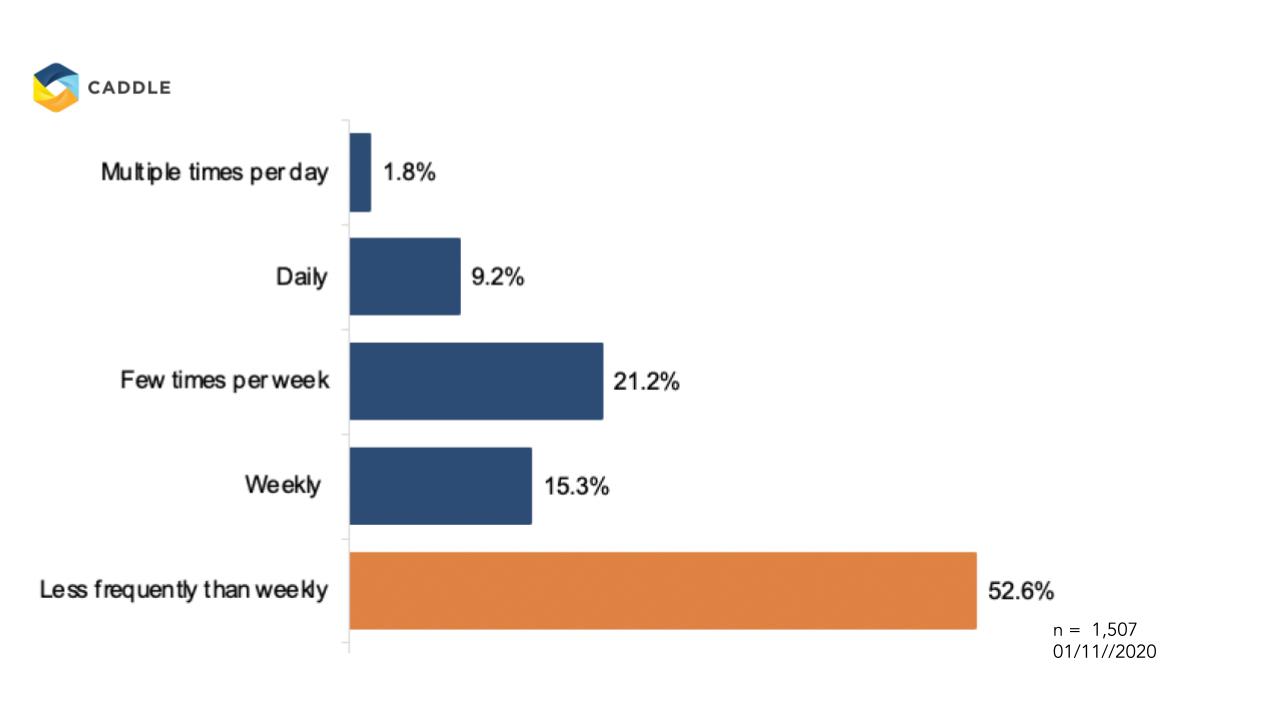

But, are there any generational differences? Yes!

Gen Z snacks more than the average consumer:

- More than 14% of Gen Z cereal snackers consume daily

- Functional products are logical choice for innovation in cereals

- Gen Z are all about taste, but as consumers age, healthy options become more important

Generation Z: How often do you eat cereal?

Key Takeaways

No.1 |

People are asking more of cereal.

No.2 |

“Cereal for breakfast” consumers remain the most lucrative for cereal brands.

No.3 |

Healthier options & functional products are areas of innovation for the cereal aisle.

So, is cereal a breakfast food or a snack food?

This is important because with increasing diet trends like intermittent fasting, the morning breakfast cereal occasion is likely to be threatened. Consumers have cereal playing the biggest role during breakfast, but younger generations, such as Gen Z, are letting cereal shine throughout their day as a snack food item.

*Disclaimer: all data presented is owned by Caddle and has a Margin of Error of 1% or lower.

Get better business insights, faster, with Caddle.

Want more Caddle Insights? Sign up to our email list!

Leave A Comment