Last updated on July 8, 2021

We’re Losing Sleep Over What?!

COVID-19 has changed the world forever. What may have been the leading stressor in many of our lives just one year ago, has expedited the rise of a more alluring leader in sleep loss – social media use.

One in three Canadians between ages 35 to 64 report not getting enough sleep in general. When we dig deeper, approximately 19 percent of respondents between ages 15-64 said they had lost sleep as a result of social media use in the previous 12 months. The association between social media and negative experiences was higher in younger respondents, with about 47 percent of 15-19 year-olds and 28 percent of 20-24 year olds reporting losing sleep from social media use.

In 2019, the global sleep economy was valued at about $432 billion USD. This industry was forecast to be worth $585 billion USD by 2024. With the increase of sleep loss among Canadians, what are brands doing to capture this growing market?

The Sleep-Aid Market

According to Canadian Grocer, and other reports, the functional beverage market is a big bet.

“In 2016, the Canadian functional beverage market had $1.4 billion in sales—a figure that’s expected to reach $1.6 billion in 2021, according to Euromonitor International. And according to Mintel’s figures, 14% of Canadians say they drink “hybrid/fusion drinks” on a typical day.”

This past year, we have seen an increase in product innovation in these categories. For example, Pepsi launched Driftwell to capture the new, growing market of sleep-aid beverages. Caddle asked our Daily Panel what they think about the sleep-aid beverage market, and here’s what we found.

When it comes to what influences consumers’ likelihood to try, free samples are not always the No. 1 factor

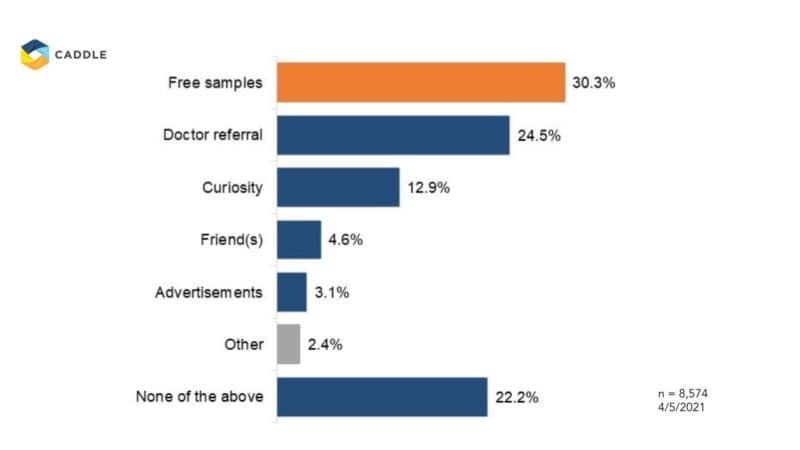

For sleep aid beverages, we discovered that the top 3 influencing factors for product trials are “free samples”, “doctor referral”, and “curiosity”. It’s interesting to note that 25% of consumers are willing to try a sleep aid beverage upon doctors’ orders. With “free samples” only 5 basis points higher than “doctor referral”, perhaps this indicates that consumers are on the fence on actually trying the product without a professional’s guidance.

From the following options, what would most likely influence you to try a sleep aid beverage?

Caddle also asked our Daily Survey Panel about cannabis-infused beverages, and had some surprising results.

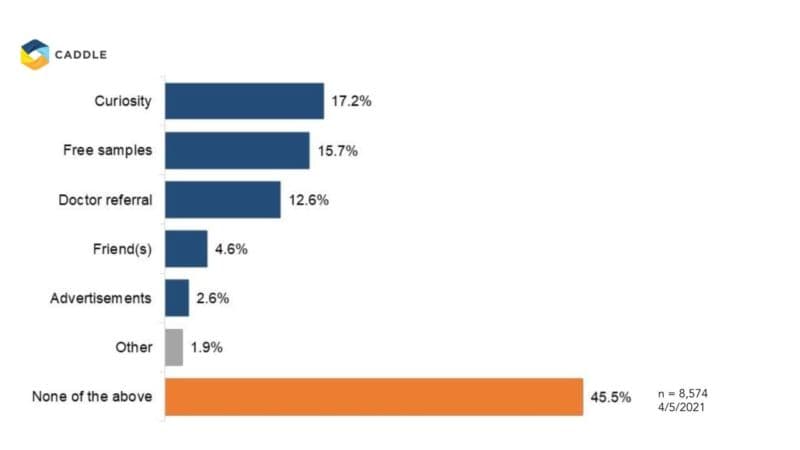

Unlike sleep aid, cannabis drinkables’ top influencing factor is “curiosity”. This suggests that consumers who are curious about the product category are the most likely to try, regardless of price. Though this does not mean price is irrelevant, since “free samples” is the No.2 influencing factor, it’s still notable that curiosity trumps freebies in this case. We see “doctor referral” ranked as the third most influencing factor. This potentially highlights the growing demand for cannabis products in the health & wellness space.

Interested to learn how Canadians celebrate 420 this year? Read our blog post here. Caddle also put out a full report on how brands can Cultivate Success in the Canadian Cannabis Business.

From the following options, what would most likely influence you to try cannabis beverages?

Key Takeaways

No.1 |

The functional beverages market- specifically products aiding sleep- is on the rise, and will continue to grow in the coming years.

No.2 |

Consumer curiosity can be a strong driver to new product trials – keeping your hand on the pulse on what consumers are actually curious about, and willing to try can make or break a product.

No.3 |

Free trial is not always the best way to conduct new product trials. However, market research is always the best way to learn what is. Contact Caddle to get started.

*Disclaimer: all data presented is owned by Caddle and has a Margin of Error of 1% or lower.

Get better business insights, faster, with Caddle.

Want more Caddle Insights? Sign up to our email list!

Leave A Comment