Last updated on October 26, 2023

As inflation affects consumer spending and alters their buying habits, it becomes crucial for retailers to adapt their strategies. Although it may be a challenging and uncertain time for both shoppers and businesses, we are confident that Caddle can help you navigate through this transition. We surveyed 3,129 Canadians in July 2023 to better understand how food inflation impacts consumer behaviour. The results of the survey were presented in a recent webinar to help retailers adjust their strategies to serve their customers better.

Our insights indicate that consumers are suffering as food prices rise while retailers struggle to reduce costs to maintain prices the best they can. Strategies for managing this from the retailers’ side may include maintaining prices by lowering profit margins, increasing prices but improving a loyalty program with incentives, moving towards private label brands, or selling products that typically would not reach store shelves to reduce cost. An appealing alternative for retailers is an impactful strategy known as “shrinkflation”. It is a practical tactic where retailers decrease the quantity of a product while keeping its price and packaging size unchanged. On the surface, it may seem like you are getting the same deal – in reality, consumers are paying the same amount for less. Shrinkflation is most prevalent in retail food products and household items but also occurs with electronics and restaurants. It serves as a way for businesses to maintain the appearance of price stability while subtly passing on inflation-related cost increases to consumers over time.

The Delicate Dance Between Shrinkflation and Food Inflation

Based on the high turnout for our food inflation webinar, shrinkflation is a growing area of interest in the food industry. As food prices continue to rise due to various factors like supply chain disruptions and increased logistical costs, companies are feeling the pressure to maintain their profit margins. To achieve this, they often resort to shrinkflation tactics. They reduce the quantity or size of products while keeping the prices steady. The result is that consumers end up paying the same amount for less.

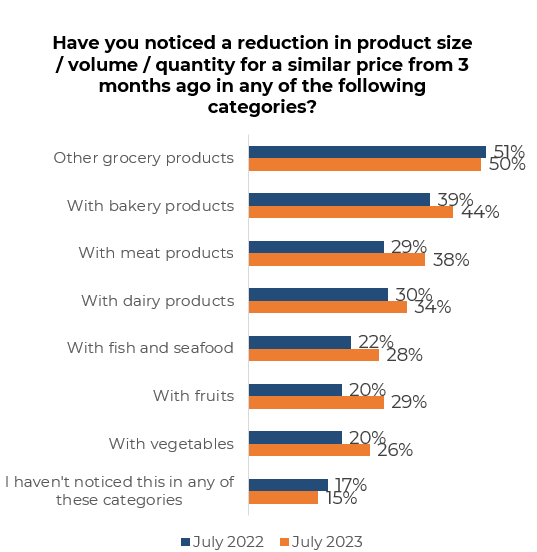

This trend has not gone unnoticed by consumers. In fact, it has pushed many to switch brands, with a 7% increase in consumers purchasing private labels, where they feel they get better value for their money. People are becoming increasingly conscious of shrinkflation, especially in categories like meat products, where awareness has spiked by 30% to 38% in 2023 compared to 29% in 2022, as seen in the survey results below. Even more noticeable is the significant 45% increase in awareness of vegetables, which is likely due to rising transport fuel and labour costs.

While the short-term strategy of shrinkflation has grown in popularity for businesses, there is a growing awareness of the need to tackle the root causes of rising food prices. Dr. Sylvain Charlesbois, known as The Food Professor, suggests that “decarbonizing supply chains is becoming a priority for a growing number of companies.” With the focus on investing in decarbonization, supply links should become highly efficient and reduce costs. This could result in organizations no longer resorting to shrinkflation to reduce costs. By addressing the environmental and logistical challenges in the supply chain, the cost of production will decrease, and companies can potentially avoid resorting to shrinkflation tactics altogether.

The Rise of Skimpflation

In the world of grocery shopping, another term gaining traction and coined by economists is “skimpflation.” Skimpflation is a phenomenon where manufacturers attempt to reduce production costs by using lower-quality ingredients while maintaining the same price for their food products. Retailers are implementing this strategy to save money on the production process to ensure they do not have to raise product prices. This allows suppliers to maintain pricing and their profit margins so that consumers do not seek cheaper alternatives. Consumers initially feel satisfied with the stable food prices and do not change their shopping habits.

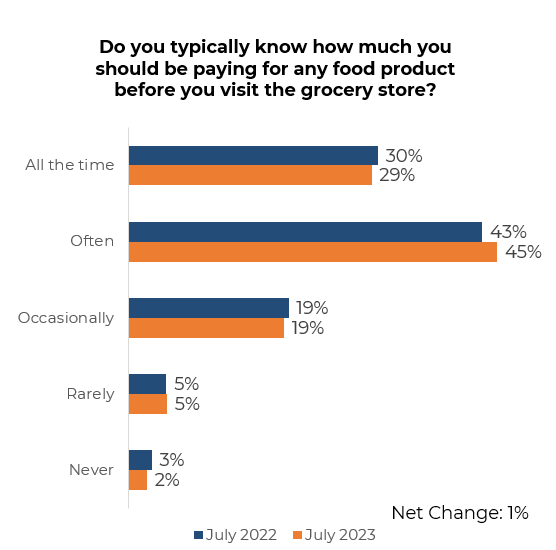

Changes in products and pricing are driving consumers to become strategic about their spending. Some consumers are realizing that products they regularly purchase have a changed list of ingredients or taste slightly different. In 2023, 74% of consumers know how much they should be paying before visiting the grocery store. Of the 74%, Baby Boomers are the most aware at 78%. Interestingly, Generation Z is 69% aware, 7% less than they were in 2022.

To stay on top of their budgets, more consumers are frequently using calculators when grocery shopping. In 2023, 37% of consumers use calculators all the time or often, a notable increase from 2022, when it stood at 32%. Generation Z (48%) and Millennials (46%) are the most likely to use calculators regularly in 2023, with Baby Boomers being the least likely at 26%. The Atlantic region has seen the highest increase in regular calculator usage, jumping by 15% from 2022.

The Growth of “Food Nomads”

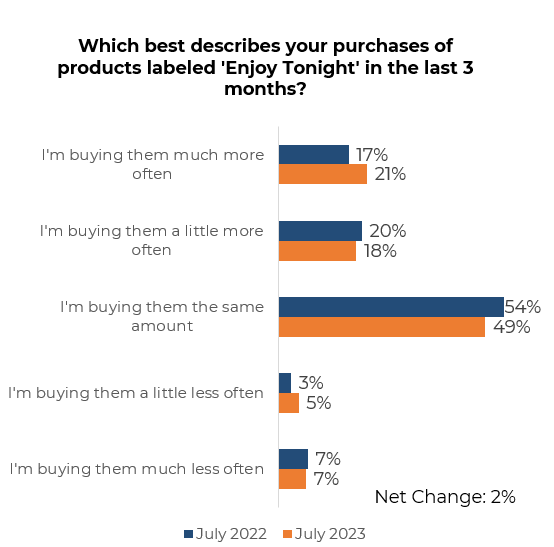

Frustration with shrinkflation and rising food prices has given rise to “food nomads.” These individuals are more willing to visit multiple stores to find the best deals on products. With many traditional grocery stores converting to discount stores, consumers are exploring alternative options, including purchasing private labels and near-expiry products.

In 2023, there’s been a 10% increase in consumers buying more products near expiry or best-before dates, reaching 52% compared to 47% in 2022. This increase is even more pronounced among Millennials and Generation X, while Generation Z is buying less near-expiry products in 2023 compared to the previous year. Regionally, the Atlantic region has seen a significant increase in purchasing near-expiry products, while the West has started buying them less often in 2023.

What Is Next?

As consumers become more aware of shrinkflation and skimpflation and its effects, companies might need to consider being more transparent about these practices. People are talking about it, and businesses should address consumer concerns proactively rather than risk backlash. The world of retail is evolving, and as consumers become savvier, companies need to adapt to their changing expectations. By taking steps to maintain consumer trust and value, companies can navigate the complex landscape of pricing strategies while ensuring their customers remain satisfied and informed. Companies could improve consumer acceptance of rising prices by including more information on product packaging regarding the reasons for the increase in costs, such as rising costs of materials, interest rates, labour, and transport. If companies fail to provide this information, consumers may be less willing to accept the higher prices. As the government suggests, transparency in pricing can help build trust and maintain customer loyalty. Otherwise, it is time to encourage competition and provide Canadians with more choices.

Reach out to our team to become a client and learn more about shrinkflation and skimpflation. You can also sign up for our free weekly newsletter to receive our daily survey data.

*Disclaimer: all data is collected and presented by Caddle

Get better business insights, faster, with Caddle.

Want more Caddle Insights? Sign up to our email list!

Leave A Comment