Last updated on September 21, 2023

In the ever-changing economic climate, it’s no surprise that Canadians are feeling the pinch when it comes to their grocery bills. The cost of food remains stubbornly high, and it’s impacting not just budgets; but also dietary choices and purchasing habits. Let’s investigate the dynamics of food inflation and how consumers are adapting to these challenging times.

The Elusive Inflation Rate

You might wonder, what IS the actual inflation rate? This is a question many have asked, as headlines last year suggested soaring numbers. The reality in the past few months, however, is more nuanced.

Dr. Sylvain Charlebois, an expert in the field, highlights the encouraging trend of decreasing inflation rates,

“I thought that July numbers were really really encouraging as far as consumers go and of course the industry because everyone in the industry wants better conditions, better pricing to remain competitive. When you look at annualize rates across the country, we are at about 3.6/3.7% compared to well over 10% a year ago. So things are much calmer than 12 months ago; it may not seem to be that way, but the conditions are much more manageable now.”

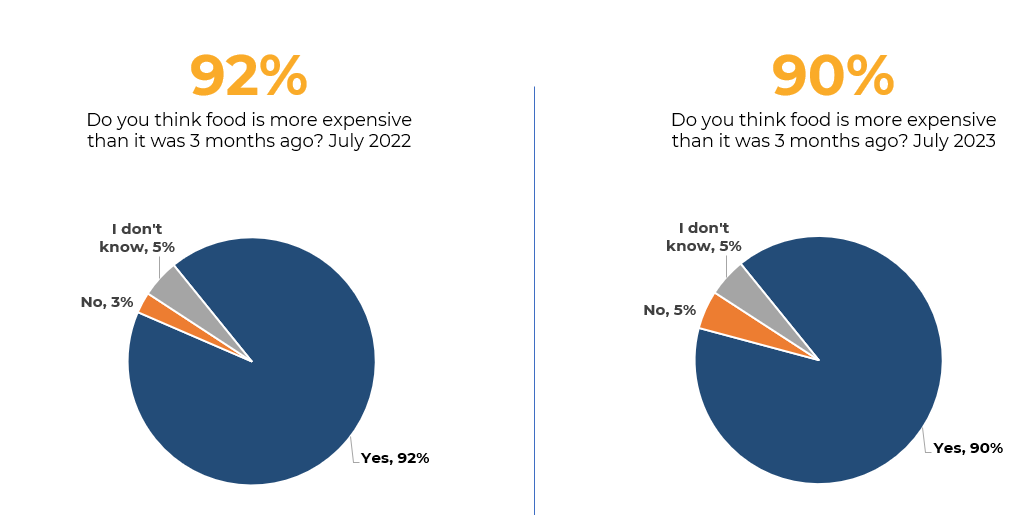

While Canadians are still grappling with high food prices, 90% feel food is more expensive in July 2023 compared to April 2023. The annualized rates have come down from the double digits the previous year. This suggests that, despite appearances, conditions are more manageable now, yet Canadians continue to feel there is a price surge.

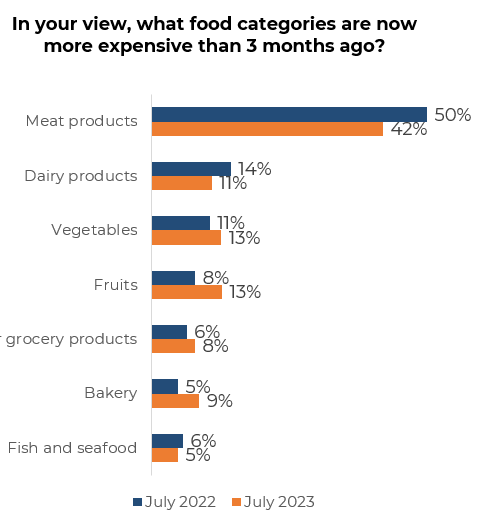

The Price We Pay for Meats

Ask any Canadian about the cost of food, and you’ll likely hear a familiar response: it’s at an all-time high. This sentiment is backed by data that highlights the soaring cost of meat products, which has risen noticeably. Unsurprisingly, this has a direct correlation with consumers’ meat consumption patterns.

As meats are the most expensive food category, Canadians are taking matters into their own hands by rethinking their protein intake. Faced with escalating prices, consumers are adjusting their purchasing behaviours, with females reducing their meat intake slightly more than males (68% females vs. 66% males). Generationally, it’s the baby boomers who are making the most drastic changes, with a staggering 71% reduction in their animal protein consumption. This shift reflects a significant societal move toward more sustainable and cost-effective dietary choices.

Adapting to Save

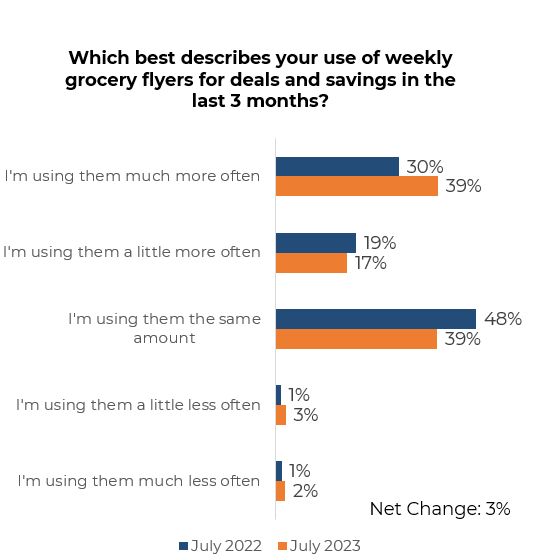

In response to these challenges, Canadians are taking proactive steps to trim their grocery bills without compromising with quality. One key strategy is paying closer attention to grocery flyers, which have become a staple for 56% of consumers. The generational divide surprisingly fades here, with millennials (61%), Gen Z (59%), and Gen X (49%) all engaging with these promotional materials.

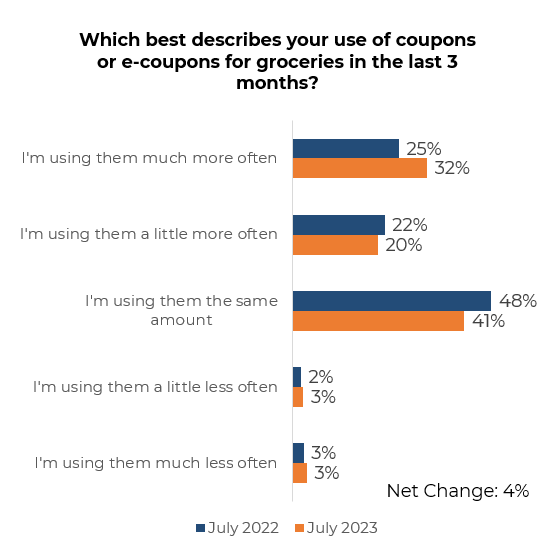

E-coupons have also found their moment, witnessing a 5% increase in usage compared to the previous year. Millennials and Gen Z lead the charge here as well, utilizing e-coupons at rates of 59% and 58% respectively. Dr. Sylvain voices concern for younger generations, “I’m very concerned about the younger generations right now due to shelter costs, food inflation, and prices going up. If you actually have a $500,000 mortgage amortized over 25 years with a variable rate, you’re likely spending $13,000 more per year just to keep a roof over your head compared to last year.” As interest rates are predicted to rise, these demographic groups face considerable financial challenges.

Budgeting and Technology

A quarter of Canadians are sticking to a budget consistently, indicating budgets have become trendy once again to improve fiscal responsibility in a demanding economic environment. A quarter of Canadians are sticking to a budget consistently; while an additional 30% follow a grocery budget regularly. This approach is particularly critical for those grappling with hefty mortgages and rent.

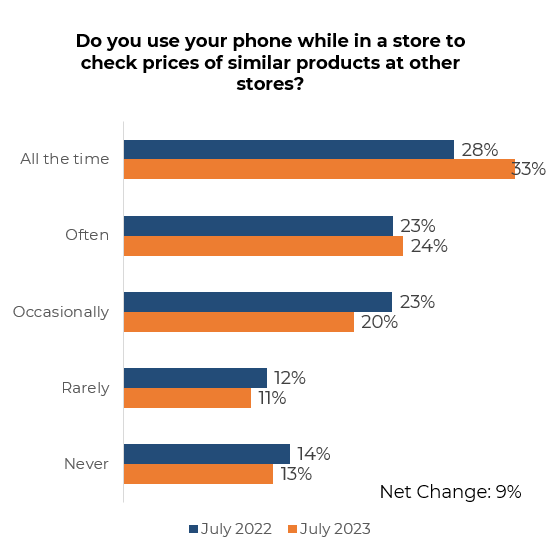

As technology advances, it becomes an invaluable tool for budget-conscious consumers. The prevalence of smartphones enables a third of Canadians to check food prices regularly via their mobile devices. This represents a 6% increase from the previous year, with tech-savvy Gen Z (72%) and millennials (67%) leading the trend. With the rise of AI-driven grocery experiences it remains to be seen whether this reliance on technology will continue to grow.

The landscape of Canadian grocery shopping is shifting, influenced by persistent food inflation. Despite the challenges, consumers are finding innovative ways to adapt. Through strategic couponing, the embrace of “enjoy tonight” meal options, and leveraging technology to make informed choices, Canadians are rewriting the rules of grocery shopping. Notably, millennials emerge as a generation at the forefront of this transformation, making substantial adjustments in response to these economic challenges. As we move forward, these modifications have the potential to fundamentally transform the manner in which we engage with the food sector and our expenditure behavior.

Reach out to our team to become a client and learn more about food inflation. You can also sign up for our free weekly newsletter to receive our daily survey data.

*Disclaimer: all data is collected and presented by Caddle

Get better business insights, faster, with Caddle.

Want more Caddle Insights? Sign up to our email list!

Leave A Comment